4 3As and the Business Model: The Business Case

3As and the Business Model: The Business Case

The business model canvas is a very effective tool for developing and evaluating business cases. The business case approach is typically applied when entities want to change the way they are currently achieving outcomes, and/or want to do new things, or do current activities better. We might call this ‘the case for change’. The business case is used to persuade the organisation to realise the opportunity (value realisation) through undertaking the project.

Typically, a business case will fulfil specific purposes:

- to demonstrate the rationale for investing;

- to identify the most cost-effective option;

- to secure funding; help make the case for continued funding; and act as a communication mechanism in helping to persuade stakeholders of the need for investment;

- and finally, to build confidence in delivery (i.e. that the project will be delivered on time, to budget, and that the defined benefits will be realised).

The business case can be used as an iterative planning document to justify our ongoing involvement with the program.

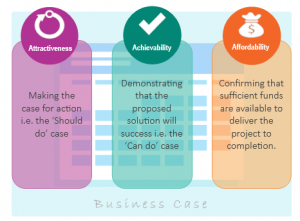

At its heart, however, the fundamental purpose of any business case is to address the 3 A’s:

The active nature of Business Case preparation, as in any business planning process, is that it is an ongoing process, not a one-off exercise. Rather, the business case should be a living document that is updated regularly to reflect progress and as new evidence becomes available.

Ultimately, the real test of any business case is whether:

- it succeeds in obtaining funding,

- how well it predicts (and guides)

- the outcome in terms of actual costs incurred, time taken to deliver, and benefits realised, so that it is likely to, confirm that that project has sound basis to justify the investment, and provides a stronger outcomes in terms of public value in relation to alternate investment opportunities.

Overall a business case analysis should be based on the following ‘3As’:

The Business Case – The ‘3 As’

Return or Attractiveness – Should we do it?

Risk or Achievability – Can we do it?

Affordability – Do we have the required funds?