Module 3: Informed Decision Making

Topic 3.2: Decision-making Frameworks

The purpose of enhanced decision making is to meet expected goals in a manner that fits the overall government objectives, and to do so in a manner that can be transparent and justifiable, within the jurisdiction’s planning processes.

For the purposes of this module, the focus here is largely on financial and business case models since finances and business cases are almost always explicitly or at least implicitly considerations you deal with.

Your planning processes typically include:

- Meeting whole of government objectives

- Fitting within Government fiscal objectives

- Delivering on strategic and operational planning parameters, typically within each agency’s domain.

Here are some brief insights into the policies and statements from various jurisdictions. Note that these are not comprehensive, nor do they report to be comprehensive or ‘best pracice’ examples. Your task here is to explore these examples, and then more carefully research those that are relevant to your context.

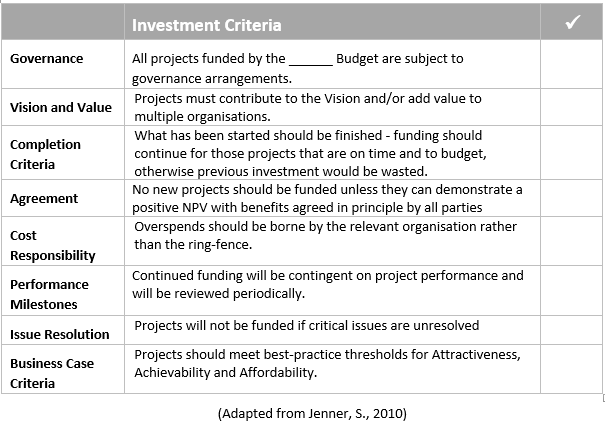

Figure 3.1 below is an example the financial management framework that is relevant to the Queensland Government. Note that there is a clear set of overall objectives for the community, linked to the government fiscal responsibility charter.

Next, you will see the relevant budget references, and finally the performance indicators that are attached to the relevant government and agency performance agreements.

Figure 3.1: The Queensland Government Financial Management Framework. 2014.

Here is a sample of statements and documents from other jurisdictions:

The NSW Financial Management Framework[1] comprises a suite of legislation, policies and procedures aimed at maintaining aggregate fiscal discipline, allocating resources in line with the Government’s strategic priorities and using Budget resources efficiently.

The key features of the Financial Management Act[2] are, to provide for the management of the public finances of the State in an economical, efficient and effective manner consistent with contemporary accounting standards and financial practices.

Determines governance, risk management and compliance requirements, to support the implementation of good financial management practices.[3]

The 2018 Government Standing Directions[4] require better financial management by agencies. Changes introduced over the past few years include requirements for stronger accountability for agency boards, Chief Executive Officers (CEOs) and Chief Financial Officers (CFOs), controls against fraud and corruption, better planning, and public attestation in agencies’ reports. Newly included are requirements for the Central Banking System. The 2018 Directions will drive a significant modernisation of the State’s financial management regime and operations.

Delivering the measures that support the government’s priorities while maintaining a sustainable fiscal position requires the government to operate within a well-defined fiscal strategy. Check out these tools and framework provide by Government of South Australia

Legislation is included in the Financial Management Act 2006. The purpose of the Act is to provide management, administration and reporting of the public finances of the State.

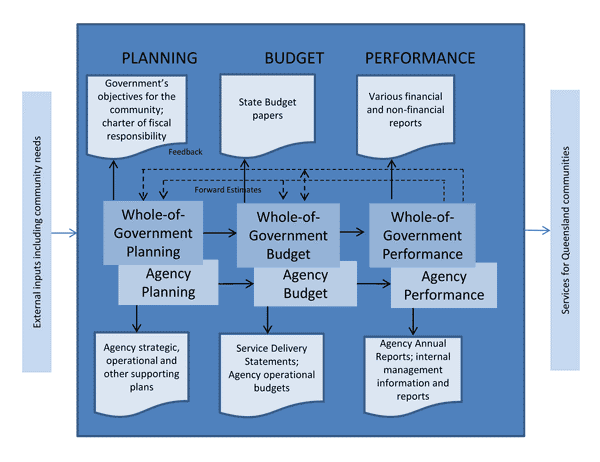

Reliability is fundamental to the process. Given that most projects require resources, typically in the form of funding and people input, then clear investment criteria are essential.

Financial criteria are often used as performance indicators that help to both scope the potential and likely project benefits, and also to measure outcomes and overall achieved benefits. The data inputs are highly relevant in light of public sector value, which is informed by such tools as the public value scorecard.

Here is a sample investment criteria checklist is provided in Table 3.1. The purpose of such a checklist is to create a useful overview for teams to have in mind as they initiate and proceed with projects.

Table 3.1 – investment Criteria[5]

Overall, data should be used to implement effective resources planning, remembering the constraints of the financial year cycle of resource use. Some of the considerations include:

- The time frame for deliverables

- The financial budget

- Non-financial resources that are necessary to complete the project.

Required

40 mins

The following site provides an overview of the Australian Commonwealth Government’s legislation and guidance in relation to resources management.

By implication, we note that overall, the purpose is to deliver the promised public value, and to do so in a manner that honours the values for each state.

Activity

Find the following resources:

- financial management framework for your state or territory, or relevant context,

- and your whole of government and agency values (or those that are relevant to your organisation)

- How do these guide you in your decision making?

- What is the connection you see between the process or framework, the values and your current projects and initiatives?

- NSW Government, Treasury, NSW Financial Management Framework. Retrieved from https://www.treasury.nsw.gov.au/nsw-financial-management-framework ↵

- Tasmanian Government, Overview Tasmania’s Financial Management Framework. Retrieved from https://www.treasury.tas.gov.au/Documents/Tasmanias%20Financial%20Management%20Framework%20Booklet.pdf ↵

- Northern Territory Government, Financial Management and Accountability Framework. Retrieved from https://treasury.nt.gov.au/dtf/financial-management-group/treasurers-directions/financial-management-and-accountability-framework ↵

- Victoria State Government, Victorian Government Standing Directions 2018. Retrieved from https://www.dtf.vic.gov.au/financial-management-government/standing-directions-2018-under-financial-management-act-1994 ↵

- Jenner, S. (2010). Transforming government and public services: Realising benefits through project portfolio management. ↵